PLAYER CLAIM News

Latest News: CJEU-Wunner Case Dated 15 January 2026 - Impact for German Player Claims?

Claus Hambach, LL.M.

Founding Partner at Hambach & Hambach

CLAUS HAMBACH studied law at the University of Regensburg and achieved a Master degree in International Business and Tax Law (LL.M.) at the Frankfurt School of Finance & Management and the University of Innsbruck. He also gathered experience with the Bayerische Kapitalanlagegesellschaft mbH (HypoVereinsbank), the German American Chamber of Commerce in Houston (USA), the Facultés Universitaires Saint-Louis (Brussels) and well renowned law boutiques in Regensburg, Hamburg and Munich. He is a General Member of the International Masters of Gaming Lawyers, a non-profit association of gaming law experts such as attorneys, gaming regulators and gaming executives.

Claus Hambach was awarded "Most Highly Regarded Individual" by THE INTERNATIONAL WHO's WHO of SPORTS & ENTERTAINMENT LAWYERS 2015. This makes him one of the leading lawyers in the category "Sports & Entertainment Law - Gaming & Gambling". Since 2016 Claus Hambach has been listed as Most Highly Regarded Individual in WWL GERMANY Sport & Entertainment.

Maximilian Krietenstein

Junior Partner* at Hambach & Hambach

Maximilian Krietenstein studied law at Julius-Maximilians-University in Würzburg, specialising in "Criminal Sciences". After passing the First State Examination, he worked for four years as an author for a legal training journal and as a scientific assistant for Hambach & Hambach.

Mr Krietenstein completed his legal traineeship (Referndariat) at the Regional Court of Würzburg, specialising in "advocacy". Mr Krietenstein passed his second state examination in 2022.

* Non equity partner

Yesterday the Court of Justice of the European Union (“CJEU”) decided in case C-77/24 (“Wunner"). The court decided that a player can generally rely on the law of his country of residence to bring a tort claim for damages against the director of an online gambling provider who does not have the required license. In Austria player-lawyers might now consider more frequently to file actions also against directors if enforcements against the operators remain impossible. In contrast to Austria the situation in Germany remains legally rather uncertain and a high-risk investment for Claim-Financers since multiple relevant cases are still pending at the CJEU, for example: C-530/24 (sports betting), C-440/23 (betting on lotto) and C-898/24 (casino & poker). Meanwhile Hambach & Hambach is preparing to enforce reimbursement of legal costs arising from hundreds of court decisions in favour of its clients and withdrawals from players, in accordance with applicable procedural law.

I. Background

For years, gambling operators have been confronted with an unprecedented wave of so-called player claims. Claims for repayment of gambling losses, based on allegedly void gambling contracts, dominated court practice. These claims were filed in large numbers, frequently financed by litigation funders and pursued through highly standardised pleadings. For a considerable period, it appeared that this development could only be countered with significant resources, while a seemingly risk-free business model had emerged on the claimant side.

Despite many German courts initially favouring the players’ argument of void gambling contracts - sometimes in a manner that could be described as bordering on “legal populism” - Hambach & Hambach has succeeded in winning more than 50% of the cases we defend. We do not hesitate to seek the recusal of judges on grounds of apparent bias where decisions are demonstrably influenced purely by moral value judgments rather than by legal analysis. At the same time, many stakeholders acting on behalf of players have underestimated the legal and technical complexity of these cases, the associated costs, and - crucially - the lack of viable enforcement options. As a result, several market participants have gone bankrupt, sold their claim portfolios, or exited the player-claim market altogether.

As already outlined in our recent TLN (How operators successfully defend player claims, by Timelaw-Litigator Maximilian Krietenstein), courts are increasingly moving away from the supposed “standard issues” of these proceedings. Instead of focusing exclusively on fundamental questions - most notably the compatibility of former gambling regulations with EU law - courts are increasingly addressing secondary yet decisive legal aspects. These include player-participation from abroad, standing issues arising from assignments to litigation funders, and the plausibility and internal consistency of the claimant’s submissions in each individual case. This development has enabled us to achieve a consistently above-average success rate for our clients, supported by access to top-tier external expertise from leading law professors who are highly regarded by the judiciary and reflected in our regular contributions to renowned legal journals.

The Munich Higher Regional Court’s decision against a player dated 27 November 2025 (case no. 3 U 3157/24e) is a representative example of the dozens of favourable high-court decisions our law firm has achieved across Germany. The vast majority of our first-instance successes are upheld on appeal by the higher courts, with only very few exceptions. The following excerpt from the above-mentioned court order illustrates the strength of our legal arguments and confirms that they also prevail at second instance:

“The Munich Regional Court I rightly dismissed the action and correctly denied the claimant’s claim for reimbursement of the stakes paid. Reference is made to the judgment at first instance. Even taking the appeal into account, no different assessment arises. The extent of the claimant’s participation in the defendant’s online games of chance within the scope of application of the Interstate Treaty on Gambling 2012 cannot be established. In the absence of a violation of Section 4(4) of the Interstate Treaty on Gambling 2012, there is therefore - irrespective of the issue of active standing and any potential incompatibility with European law - no claim by the claimant for reimbursement. In detail: […]”

This trend has not only continued but has accelerated significantly in recent months. With a team of 15 specialised gambling law experts, we obtained several dozen favourable Higher Regional Court decisions in the past year alone, the majority of which are now legally binding.

These results were not achieved through a schematic defence strategy, but through a consistently strategic and individualised approach. As described in our last TLN, from the outset we have focused on analysing each case on its own merits and targeting the structural weaknesses of player claims. In numerous proceedings, player participation from abroad led to claims being dismissed as insufficiently substantiated. Similarly, the widespread practice of assigning claims to litigation funders has proven legally vulnerable, particularly with regard to standing and the right to sue. In addition, standardised pleadings often fail to withstand detailed factual and procedural scrutiny. As a result, the much-discussed proceedings currently pending before the CJEU (see below) have little impact for cases defended and won by our law firm.

Beyond the success achieved in a large number of cases, a further decisive development has now emerged: the purely defensive phase has ended. Our clients are now able to take an active role and enforce the recovery of legal costs arising from binding judgments against players. Legal costs are being recovered, economic dynamics are changing, and initial effects are becoming visible among litigation funders and claimant lawyers.

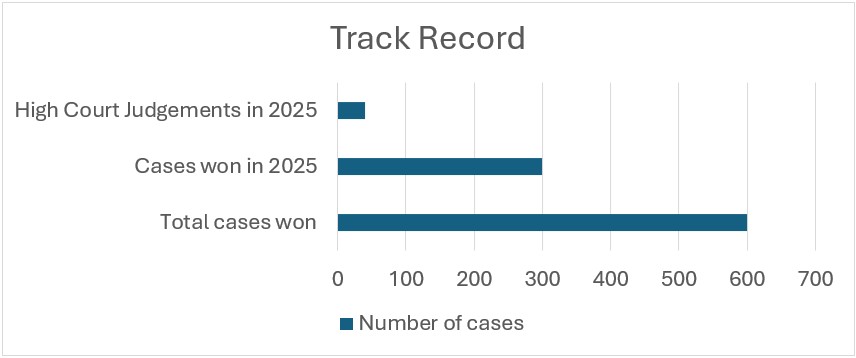

What was already apparent as a clear trend last year (see insofar previous TLN) has now become reality. Hambach & Hambach has won more than 600 cases, including over 300 in the past year alone, among them several dozen Higher Regional Court decisions.

This has resulted in a remarkable overall situation: while players and litigation funders, under Maltese law, are often unable to enforce judgments against our clients due to public policy considerations, our clients are increasingly able to initiate enforcement measures against players and litigation funders themselves.

Final judgments are no longer recorded merely for statistical purposes but are enforced consistently. Court fees, legal costs, and other expenses are being recovered comprehensively and with determination.

The effects of this development are substantial. Players - and consequently the litigation funders behind them - are now exposed for the first time to direct and immediate economic consequences. Litigation funders, whose business models assumed of a largely risk-free environment, are coming under significant pressure and are unable to absorb the enforcement risks that have materialised. As a result, the willingness to finance new claims is declining noticeably. The balance of power is therefore shifting sustainably in favour of our clients.

The success of Hambach & Hambach is the result of a clear and consistent strategic approach, which is now paying off in full. Each case is assessed individually, factual and legal weaknesses are identified with precision, and a tailored defence strategy is developed accordingly. The issues currently pending before the CJEU (including cases C-530/24,

C-440/23, C-9/25, C-778/25, and C-898/24), which concern a wide range of different legal aspects, consequently, recede into the background. What ultimately proves decisive are the legal details that are often overlooked in mass litigation but determine the outcome in court.

II. Possible influence of the Wunner judgement

The CJEU has issued its judgment in case C-77/24 (Wunner), clarifying certain conflict-of-laws aspects in cross-border disputes related to online gambling.

The case arose from a reference by the Austrian Supreme Court and concerned an Austria-resident player seeking reimbursement of gambling losses from the directors of a Malta-based online casino. The operator allegedly offered online gambling services in Austria without the required national licence and subsequently became insolvent. The claim was therefore brought directly against the directors in tort, alleging breaches of mandatory gambling and player-protection laws.

The CJEU addressed two issues under the Rome II Regulation. First, it held that tort claims against directors based on alleged infringements of gambling and player-protection rules are not excluded as company-law matters. Second, in cases of pure financial loss, the Court confirmed that the place where the damage occurs is the player’s habitual residence, resulting in the application of the law of that state.

While the decision may be taken into account in future player-claim litigation, its practical significance should not be overstated. Under German law, tortious liability of directors vis-à-vis third parties remains exceptional and subject to strict requirements, including director-specific conduct and fault. Breaches of corporate duties primarily give rise to internal liability towards the company and do not, as such, establish direct claims by players.

The decision is unlikely to have a significant impact on the question of whether claims are inconclusive if the player cannot prove that all participation in the games took place from Germany. Insofar, it should be noted that all Higher Regional Courts to date have consistently confirmed the applicability of German civil law. The decisive issue therefore remains the assessment under substantive law.

In this context, any participation in games offered from abroad remains relevant. Most of the Higher Regional Courts have rejected claims where the extent of such foreign participation could not be clearly established, and there is no indication that the CJEU’s judgment alters this established approach.

Furthermore, Advocate General Emiliou emphasised the need to draw a strict distinction between the applicability of German law pursuant to the Rome I Regulation and the scope of application of the German State Treaty on Gambling. This position has recently been echoed in opinions issued at Higher Regional Court level. The CJEU’s reasoning should therefore be read in its proper context and does not, as such, suggest a shift in the substantive assessment of player claims.

III. Consequences

Overall, the ruling in the Wunner case is unlikely to have a big material impact on the prevailing case law. Its practical relevance will depend on how national courts integrate the CJEU’s statements into their existing analytical framework. Moreover, important questions concerning player claims are still pending before the CJEU (see above), and limitation periods continue to apply. The practical impact of Wunner will therefore largely depend on how national courts, particularly in Germany, interpret and apply the ruling in future cases.

Online Gambling News

Update - Influencer Advertising for Online Gambling – Dead, Revived, Regulated?

Phillip Beumer

Junior Partner* at Hambach & Hambach

Phillip Beumer is Junior Partner* at Hambach & Hambach. He advises national and international clients in the gaming industry, including listed providers in the online sector. Mr. Beumer's practice focuses on regulatory compliance and special administrative law and he has guided sports betting operators, online casino operators and online poker providers through various licensing proceedings. Mr Beumer is co-author of the Legal500 Country Comparative Guide Gambling Law Germany.

*Non equity partner

The introduction of the interstate treaty on Gambling (ISTG) in 2021 first brought the freedom of licensed operators to freely advertise their brand and product without requiring additional permission by the supervisory authorities. “Freely advertisings” of course did not allow for any and all advertising but within the regulatory framework of the gambling laws and importantly within the boundaries set in the operator licenses.

Unfortunately for the industry, the German Gambling authority GGL and its predecessor had a very narrow understanding of this freedom to advertise. In the license, they included, inter alia, a complete prohibition of “influencer-marketing”.

This complete crackdown on influencer-marketing was challenged in court, immediately after the first operator licenses were issued in late 2022. Since then, the courts have evolved a rather nuanced case law on influencer advertising for gambling operators. This article shall give an overview of the relevant decisions and what they mean for operators and advertisers.

First decision by administrative court Hamburg in 2022

As early as December 2022, the administrative court in Hamburg (file no. 14 E 3058/22) had already outlined that a complete prohibition of influencer marketing was unlawful as the regulation lacked proportionality.

Against the background of the requirements for advertising permitted gambling pursuant to Section 5 (2) GlüStV 2021, it would appear to be disproportionate to impose a blanket ban on advertising by influencers even if the advertising is “scripted” and controlled by the license holder and is thus attributable to the license holder without restriction.

The prohibition was also found to be unnecessary, as licensees are already prohibited by law from commissioning third parties with autonomous advertising. The law allows operators to commission third parties with implementing advertising measures but not to design the advertising themselves. According to the court “there is no need for a further ancillary provision which would ultimately have the same effect and only allow advertising measures with influencers if they are based on a manuscript controlled by the license holder.”

It has to be noted that the operator involved was a social lottery operator. In many ways, social lotteries are treated differently to sportsbooks or slot operators. However, the statements of the court regarding missing proportionality and responsibility for the advertising ban could be universally applied to other operators.

2023 - Higher Administrative Court Saxony-Anhalt

Backed by this clear case law, slot and poker operators made their case at the competent higher regional court Saxony-Anhalt (who has jurisdiction where the regulator is seated). However, the court did not respond in the desired manner, but decided in favour of the complete influencer ban with a peculiar argument:

The higher administrative court (file no. 3 M 14/23) initially upheld the ban on influencer advertising. Importantly, in principle, they agreed with the statements by the beforementioned administrative court Hamburg: The higher administrative court Saxony-Anhalt stated, that influencer marketing does not violate section 5 (1) sentences 1 and 2 ISTG 2021, insofar as the advertising carried out by the influencer is "scripted" and fully controlled by the licensee, so that it can be attributed to the gambling operator without restriction. The court, however, upheld the influencer advertising ban, because the time restriction pursuant to section 5 (3) sentence 1 ISTG 2021 (i.e. the internet advertising ban between 6 a.m. and 9 p.m. that applies to slot and poker operators in Germany) also applied to it, arguing that it is unrealistic that influencer marketing can actually be practicably realized in compliance with the existing time restrictions.

This decision failed to consider that the watershed times for slot and poker operators are already regulated by law in § 5 (3) ISTG. If the court was not convinced that influencer marketing could be restricted to the allowed times, this would have been a breach of a different statutory provision. This, however, applies fully independently from the influencer regulation.

In a decision dated 19th December 2023 (file no. 3 M 88/23), the higher administrative court acknowledged this argument and went back on its original argument:

“The prohibition of influencer marketing raises serious legal concerns insofar as advertising on the influencer’s own channels, between the hours of 9 p.m. and 6 a.m is affected.”

“The Senate no longer fully maintains that a time limit is impracticable. Time-limited marketing should be practicable on influencers' own channels, so that the ban on influencer marketing between 9 p.m. and 6 a.m. is likely to be unlawful in this respect.”

With this decision, the court declared that the complete ban of influencer marketing is unlawful, but restricted the compliant advertising by influencers to advertising on “their own channels”, i.e. not on public social media platforms. The reasoning behind this limitation was that, according to the court, ensuring compliance with the “embargo time” requires auditable administrative and technical limitations. The court found that since the operator does not have the means to ensure those limitations on external social media platforms, the permissible influencer advertising is restricted to their own channel.

2025 - Higher Administrative Court Saxony-Anhalt

The decision in December 2023 already marked a turning point in the case law of the higher administrative court Saxony-Anhalt. Still, the scope of permitted influencer-marketing was limited due to the reference to the influencer’s “own channels”.

“The Senate considers a ban on influencer marketing, with the sole exception of advertising on influencers' own channels, to be too far-reaching, because it should not be impossible for the respective licensee to ensure that influencer advertising is also “scripted” outside of their own channels and thus remains under their full responsibility. There are no sufficient indications that corresponding requirements for influencer marketing are not being observed. […] Even if advertising on influencers' own channels were exempt, a ban on influencer marketing would therefore also cover advertising that is not considered inadmissible under the standards of the State Treaty on Gaming. Insofar as risks arise from the specific circumstances of influencer marketing, such as the environment and location of product placement, the authority is required to limit any bans to advertising that arises from the specific circumstances in question.”

Main learnings

With this decision, the courts have now established a case law which allows for regulated marketing with influencers.

The main learnings from this case law are:

- Scripted influencer marketing is compliant with the ISTG 2021;

- This requires operators to introduce legal and technical controls of the advertising messages;

- With regard to the scripting, the court expects the gambling authorities to specify which kind of scripting they consider lawful or not;

- The scope of influencer marketing is not limited to the own channels of the influencer but can be extended to external channels;

Response by the Joint Gambling Authority of the Federal States (GGL)

In December 2025, the GGL reacted to the case law that the courts had established. Referring to the decisions by the higher administrative court Saxony-Anhalt, GGL waived their right to enforce the influencer-ban during pending court proceedings. Until now, the authority limits this waiver of enforcement to operators that sued in the jurisdiction of the higher administrative court Saxony-Anhalt. This is not the case for many sportsbook operators that are supervised by the GGL. Since current sportsbook licenses were awarded in 2022, operators did not file court claims in Saxony-Anhalt but in Hesse, where the predecessor of GGL for sportsbooks was located at the time. Such practice might lead to unequal treatment between operators and may distort the market due to the possibly unjustified distinctions in jurisdiction. The license provisions on influencer-marketing are identical in sportsbook and slot/poker operator licenses. The authority will have to present a good reason for treating comparable situations (operators) differently.

Outlook:

2026 will see case law on influencer marketing for iGaming evolve further as we expect final judgements by the higher-administrative court Saxony-Anhalt on that topic. Furthermore, one can assume that once a judgement is handed out, either defeated party will seek final clarification at the Federal Administrative Court. A further key question will be whether GGL provides guidelines on scripting to operators as expected by court until a final decision is made by the Federal Administrative Court on the legality of influencer marketing for gambling products.

Online Gambling News

iGB - Expert Interview with Dr. Wulf Hambach

Dr. Wulf Hambach

Founding Partner at Hambach & Hambach

DR. WULF HAMBACH is one of the founding partners of Hambach & Hambach (www.timelaw.de). He is a co-publisher and one of the authors of the legal commentary “Glücks- und Gewinnspielrecht in den Medien” (Gambling and Sweepstakes Law in the Media, C.H. Beck Verlag). Since more than two decades Dr. Hambach is a sought-after lecturer at leading international conferences and board adviser of leading internet service companies. Lately he was involved as legal adviser in large M&A deals in the area of digital gaming services.

Furthermore, he is Head of Regulatory at Hambach & Hambach and leading the team, consisting of the highly experienced lawyers Dr. Stefanie Fuchs-Raicher, Dr. Stefan Bolay, Phillip Beumer, Maximilian Krietenstein, Christina Kirichenko, Christian Reidel and Maximilian Kienzerle.

European gambling regulation’s quiet convergence: Is cross-market harmonisation the answer?

Legal and regulatory experts consider how Europe may seek to harmonise regulation across various sectors that touch on gambling.

For most of the past year, Europe’s gambling regulators have been transfixed by two familiar villains: tax hikes and the black market. Higher levies enforced in 2025 are meant to fund public spending and discourage excess, while tougher enforcement was supposed to squeeze out illegal operators.

Instead, many European headlines have told a more nuanced story. Licensed operators complain of shrinking margins and regulators of stubbornly resilient illegal operators, while in the end there has overall been minimal improvement in consumer protection as a result of tightened regulation.

As 2026 commences, the question for Europe’s iGaming industry is not whether these themes will persist, but what else is coming into view? According to a string of industry figures, the next phase of regulation is likely to be less dramatic than a sudden tax shock, but potentially more consequential: a gradual shift towards affordability controls, technical standards and de facto harmonisation across borders.

This is unlikely to happen through an EU-specific gambling law, but rather through quieter mechanisms that may ultimately reshape how the industry operates and limit fragmentation.

Standards before statutes

For decades, gambling policy has been justified by moral, public health and fiscal considerations. That is unlikely to change. Yet Europe’s online market is borderless, and national rules increasingly collide with shared infrastructure: payments, platforms, data and algorithms. The result is a form of harmonisation that already binds operators, whether regulators acknowledge it or not.

Gambling firms across the EU must comply with the General Data Protection Regulation, anti-money laundering rules, consumer protection law and, increasingly, the Digital Services Act. The forthcoming AI Act will add another layer, governing how automated systems score risk, personalise player offers or trigger interventions. None of these laws are gambling-specific, but together they standardise much of the compliance machinery around gambling.

This horizontal framework makes technical convergence easier than political harmonisation. Bjorn Fuchs, chairman of the Dutch trade body VNLOK, observes that there is already “a move towards harmonisation in European gambling, through various ongoing projects, co-operation and research”, even if much ground remains to be covered.

Dr Wulf Hambach, managing partner at Hambach & Hambach, agrees that regulators are exchanging experiences more intensively between markets, but notes that national authorities remain cautious in importing foreign standards wholesale.

History suggests why. In other regulated sectors, legal harmonisation has often proved insufficient on its own. As Hambach puts it: “European experience across regulated industries shows that regulatory harmonisation rarely succeeds through top-down political acts.”

Financial services illustrate the point well, he explains. Early EU frameworks relied on minimum harmonisation and mutual recognition, assuming that shared rules would deliver consistent outcomes. The financial crisis exposed the flaw in that logic. “Legal harmonisation is necessary but insufficient,” Hambach argues.

The same lesson runs through payments and data protection. Even under fully harmonised regimes, outcomes diverge when enforcement cultures differ. “Convergence only becomes effective when supervisory expectations, enforcement practices and operational interpretations are aligned,” he says. Otherwise, “even highly harmonised legal frameworks can magnify differences in national regulatory culture”.

The implication for gambling is uncomfortable but clear. The general analysis is a single EU gambling law is neither realistic nor necessary. What matters is whether regulators can agree on common technical definitions – of harm markers, risk indicators, reporting formats – and align their supervisory expectations around them.

From best practice to obligation

This is where standards bodies and industry initiatives enter the frame. The European Committee for Standardisation has already approved EN 17531, a common reporting standard to support the supervision of online gambling. The European Gaming and Betting Association has also pushed ahead with standardised “markers of harm”, designed to identify risky behaviour across markets.

Such initiatives are formally voluntary, but in practice, they rarely remain so, Hambach says. In many regulated sectors, voluntary standards become de facto requirements once supervisors build their processes around them. Germany’s experience with information-security standards is instructive. Hambach puts forward the example of ISO/IEC 27001, an international standard for information security management systems which began as best practice but is now widely treated as a licensing requirement, even without explicit statutory mandates.

The same dynamic is likely to apply to AI and harm-detection systems within European gambling. Pekka Ilmivalta, head of Nordic Legal’s Finnish office and a veteran of national gambling reform, predicts that AI and harm-detection standards “will certainly develop from being a best practice to become a compliance requirement”. The open question, he adds, is whether regulators will merely set expectations or assume a more central role in data-driven oversight.

Fuchs stresses that “AI harm detection systems are a means to an end”, but he sees their potential. “When there are sufficient common standards for elements regarding harm detection, AI systems could most definitely become a foundation for future enforcement and licensing,” he adds. Real-time analysis of behaviour, he argues, is already improving consumer protection.

However, not everyone is convinced that standardisation equals harmonisation. In Denmark Morten Rønde at Spillebranchen doubts that Europe is moving toward de facto alignment, arguing that national measures remain driven by “local opinion trends rather than solid scientific evidence”. He also warns against rigid, one-size-fits-all controls. Experience from finance and data protection, he says, shows that principle-based, technologically neutral rules work better than static thresholds.

Yet even sceptics acknowledge that the direction of travel favours convergence. Once regulators begin to rely on shared data structures and indicators, divergence becomes harder to sustain.

The Dutch experiment in European gambling

Some markets in Europe could clearly benefit from a Europe-wide approach to regulation, particularly as political sentiment towards the European gambling sector has suffered massively in markets like the Netherlands in recent years.

Having liberalised online gambling only in 2021, the country is already reconsidering its framework. Policymakers are discussing tighter financial limits, potentially linked to players’ means, and are commissioning studies to assess their impact.

Fuchs sees the logic. “If we’re committed to consumer protection, we should strive for the most effective way to do so. As such, an affordability-based approach is a good perspective,” he says, noting that elements of affordability already exist in various European regimes. But he also sounds a warning familiar to Dutch regulators: “Over-asking the consumer will inevitably push them towards the black market.”

Rønde is blunter. With channelisation in the Netherlands reportedly around 50%, he calls the situation “a serious warning sign”. Advertising bans, affordability limits and high taxes may each have played a role, but the outcome is clear enough. “There is little reason for other countries to look to the Netherlands for regulatory inspiration,” he argues.

Others are more cautious. Ilmivalta says the Dutch experience will be watched closely, but hopes it does not become a continental template for European gambling. “Most legislations are missing relevant information to support effective measures,” he says. Rather than rigid financial thresholds, he would prefer “a less custodial AI-based means to enhance responsible gaming and to intervene when the individual need is real”.

That distinction – between static limits and dynamic assessment – points to a broader regulatory shift.

What will dominate European gambling regulation in 2026?

Reflecting on regulation in 2025, Fuchs expects taxes and black market enforcement to “remain very dominant headlines in 2026”. He says consumer protection and operator duty of care are becoming inseparable from those debates. “Overregulating and over-taxing will cripple legal operators, which will diminish the net consumer protection,” he says. The logic is simple: if licensed products become unattractive or awkward, players drift elsewhere.

That risk is already visible in markets that have tightened fastest. Rønde warns that regulatory changes in large, mature European gambling markets such as Britain and Denmark “risk putting licensed operators at an even greater disadvantage compared with black market operators”.

Enforcement, he notes, has struggled to keep pace with unlicensed visibility on television and social media. “If regulation continues to tighten without effective enforcement, there is a growing risk that consumers will be pushed away from licensed products and toward unregulated offerings.”

Germany offers a particularly stark illustration. Despite years of restrictive measures, channelisation into the legal online casino market remains weak. Recent studies cited by regulators suggest that illegal offerings still command a large share of online slots play. Hambach notes that this should not surprise anyone: punitive taxation and product constraints can undermine the very channelling regulators seek to achieve.

The lesson is not that regulation is futile, but that blunt instruments have diminishing returns. That has prompted regulators to look elsewhere – toward affordability, data and technology.

The future of black market growth

One area where Europe lags noticeably is market-facing clarity. In many countries, players struggle to distinguish legal from illegal offers online, particularly as hybrid formats blur traditional definitions of gambling. That undermines both enforcement and consumer trust.

Other jurisdictions have learned this lesson the hard way. Ontario’s online gaming framework, launched in 2022, treated consumer recognition as a regulatory objective. By making licensing visible and restricting how unregulated operators present themselves, the province achieved high awareness of legal sites. Research published in 2023 showed that more than 86% of Ontario’s online gamblers knowingly played on regulated platforms. European regulators, by contrast, often concede that players cannot easily tell the difference.

The parallel with product safety is telling. As Hambach highlights, CE markings and mandatory labelling across legal gambling sites cannot replace enforcement, but they make regulation visible, giving consumers and authorities leverage. Gambling, with its increasingly digital and hybrid products, may need similar signals if channelling is to improve.

A quieter convergence

Taken together, these threads point to a subtler regulatory shift in 2026. Taxes will rise in some places; enforcement campaigns will continue. But the more durable change is likely to be a gradual convergence: common standards layered onto existing EU-wide regimes, shared data and AI governance and closer cooperation among supervisors.

Hambach expects the fight against the black market to remain central, but stresses the need to “strike a careful balance between the risk of further player migration to the black market and the need to strengthen the attractiveness and competitiveness of legal offerings”. That balance will increasingly be mediated through technical rules rather than headline-grabbing bans.

European gambling regulation could see operators and regulators acting in a more harmonised manner across borders, by agreeing on how to measure risk, report data and deploy technology, even as each member state keeps full control over its European gambling laws. For operators, that may feel less dramatic than a new tax rate – but it could prove far more consequential.

See original publication from 9th January (Martin Bjoerck) on iGB.

Meet the Team

Editorial details

TIME Law News offers gratuitous information on current development in European and international gaming law of the TIME industries / Telecommunication – IT – Media & Entertainment.

Hambach & Hambach do not accept any liability for the accuracy of the contents of TIME Law News.

Please note that TIME Law News is only meant to serve as a source of information and can under no circumstances replace legal advice by a lawyer.

Re-printing (second publishing) is only admitted in case of gratuitous dissemination and under the condition of quoting the source and address information (on the internet with the additional requirement of a link). Please also provide us with a specimen copy.

The TIME Law Newsletter has been registered with the national ISSN centre for Germany (ISSN 1866-7848).

Publisher: Hambach & Hambach Rechtsanwälte PartG mbB

Address: Haimhauser Str. 1, 80802 Munich, Germany

Tel. +49 89 389975-50 / Fax +49 89 389975-60

https://www.timelaw.de / info@timelaw.de

Responsible editor: Dr. Wulf Hambach

Editors: Dr. Wulf Hambach (responsible according to the German press law), Claus Hambach LL. M., Dr. Stefan Bolay, Dr. Stefanie Fuchs-Raicher, Maximilian Kienzerle, Phillip Beumer, Christian Reidel, Simone Schünemann, Ferdinand Spann, Maximilian Krietenstein, Simon Deimel, Christina Kirichenko